Producers

Bridge the

financing gap

In many countries, financing is a core bottleneck faced by producers, while also an essential asset for long-term farm health: This is why farmer financing is an objective of its own under our Responsible Business Program.

Coffee producers may be trained on the correct use of fertilizers, on rehabilitation and renovation, or on improved processing, but often they lack the funds to act according to their knowledge. Agriculture professionals in general, and especially smallholders, are often seen as too “risky” or too “costly” to lend to because of external variables such as weather or market prices, in addition to their remote locations, missing collateral, lack of financial minimums or even lack of a bank account. By providing farmers and farmer groups with easy access to loans, we aim to bridge the existing financing gap left by banks and even microfinanciers.

Smallholder Livelihoods Facility

To achieve our objective, NKG created a unique, joint risk-sharing credit line with four organizations: DFC – U.S. International Development Finance Corporation, IDH – the sustainable trade initiative, and the European banks Rabobank and BNP Paribas. The $25 million Smallholder Livelihoods Facility is the first sustainable farmer financing facility with a global reach and where commercial banks have joined forces with development and governmental organizations in taking a direct credit risk in lending to smallholder farmers and farmer groups in developing countries. The novel risk-sharing structure enables NKG to scale its portfolio of loans to some of the poorest farmers in the world. NKG exporters can access the revolving credit line to offer credit to producers with easy and quick processes.

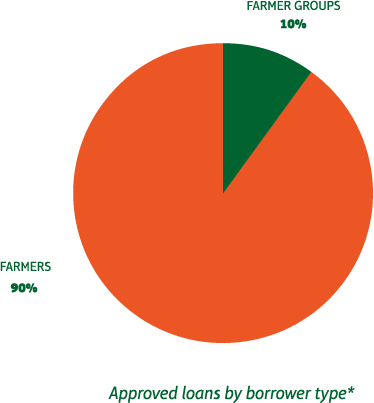

Since the start of the Smallholder Livelihoods Facility, our export companies in Honduras, Kenya, Mexico and Uganda have accessed the funds to lend to farmers and farmer groups. Between April 2021 and March 2022 our loan portfolio had the following key characteristics:

*Both figures refer to the share in terms of amount disbursed.

CASE STUDY

Mobile money in Uganda

Below 1 USD: Such tiny advances are only possible in Uganda due to the advanced mobile money ecosystem. By entering a simple USSD code on their mobile phones, NKG Bloom farmers in Uganda can request money, repay money and inform themselves about coffee prices and their balances.

Before farmers can use the service, the conditions are explained, advance limits are set based on repayment capacities and contracts are signed. From just April 2021 through March 2022, more than 6,000 farmers accessed fertilizer through our advance service and more than 2,000 used our offer of unconditional money advances via mobile money. The mobile money advances can be accessed any time, to cover extraordinary expenditures such as health costs; we have also seen a spike in requests when school fees are due.

Financing, which was launched in 2017 in Uganda, is the key element of NKG Bloom, but it is not the only key element for success. NKG Bloom started out as a full fertilization scheme, offering higher-quality fertilizers than were available in the market before and trainings on applying the fertilizers correctly, as well as on financial literacy. This combination has resulted in higher yields and net incomes at the farm level and in repayment rates above 99 %.

productivity

net income

CASE STUDY

Long-term financing in Honduras

Long-term financing in Honduras

Due to the age of coffee trees, climate change, pests and diseases – especially coffee rust – around 40 % of the world’s coffee areas are in need of renovation or rehabilitation. This means productivity and resilience will increase by replacing the coffee trees with new trees, or by stumping and pruning the trees significantly to revive plant health. Yet, for producers this means not only paying for new plants and labor, but also foregoing income from the coffee plants for one to three years. Without external financing, this is often an insurmountable barrier to renovation and rehabilitation.

Filling this gap, Becamo has adapted its program Renovando mi Cafetal to include long-term loans for farmers. Before any loan is provided, Becamo uses the producers’ history with Becamo and a socioeconomic analysis conducted by its agronomists to determine the payment capacity of the producers and ensure the producers are committed to and understand the terms of the financing.

Compared to financing via banks, this is a simple process that allows even smallholder farmers to access long-term loans. In order to ensure the success of the renovation program, Becamo has invested in the first ECOPIL nursery in Honduras, which received the Silver Level Certification of World Coffee Research. Becamo also offers producers access to quality inputs: It uses soil analysis to create individualized formulas for fertilizers that are more efficient and delivers them to the producers. Lastly, Becamo is investing in technical assistance to farmers with at least three farm visits per farmer per year and additional group trainings oriented to good agricultural practices, optimization of resources and adaptation to climate change. In practical terms, this helps guide coffee producers to improve their production systems to increase productivity, improve coffee quality and develop business skills.

since 2020

Financing plus services is the formula for success

Running a business always requires investments, and coffee farming is no exception. Since launching the Smallholder Livelihoods Facility, we have seen the tremendous impact that financing can have, and that indeed it often is the key yet missing ingredient for producers to take their farms to the next level. In most instances, ensuring the success of financing requires providing a package of services to each farmer. Linking financing with the right inputs and agricultural and business trainings based on farmer needs is essential to ensuring the success of the investment, increasing the returns and reducing the risks. Thus, what makes the model truly innovative is that the credit offerings are coupled with an ecosystem of services for smallholder farmers in NKG’s supply chains, which enables them to maximize their incomes from coffee, thus making them more resilient and better able to transform their livelihoods. This in turn reduces credit risk, as the integral set of services are designed to increase farmers’ profitability and thus their ability to repay the loans.

References

Knowing what works – Central project evaluation of develoPPP.de Strategic Alliance Farmers as entrepreneurs in Uganda Sustainable Coffee

Challenge (n. d.): Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) (2021). Central project evaluation develoPPP.de

Strategic Alliance: Farmers as entrepreneurs in Uganda. [Online]. Available at: https://mia.giz.de/cgi-bin/getfile/53616c7465645f5f8e6034f6d1b2a1d906568bc8379222b1ff0d1cc4b9a45f2c556350eddc514e1eedddc3625b4732ff4a6dd695c23ef37805a8162375e2eaa1/giz2022-0039en-projectevaluation-developpp-farmers-entrepreneurs-uganda.pdf

RELATED

sustainable

development

goals