Planet

8

Measure and enhance our environmental performance

At NKG, we recognize the urgent need to address climate change and to limit global warming. The corporate sector significantly influences global greenhouse gas emissions, giving companies a crucial role in protecting our climate and ensuring a seamless and successful transition to a low-carbon economy. Understanding the environmental impact of our operations is critical. As part of our Responsible Business Program, we prioritize assessing our environmental footprint and adapting our business model to support a low-carbon future.

Our Journey

Our journey towards measuring our environmental impact began in 2021 when we developed a robust methodology and calculated the carbon footprint of a pilot group of companies. We used the Greenhouse Gas Protocol Corporate Standard (GHGPCS)1 as a guideline to compile our GHG inventory. In 2022, we expanded this measurement to the entire group, publishing our first corporate carbon footprint (CCF) as a baseline in the NKG Sustainability Report 2022. This initial assessment highlighted areas for improvement in data quality and understanding. Consequently, we adopted 2022 as our new baseline due to its more comprehensive and accurate representation of our operations and emissions.

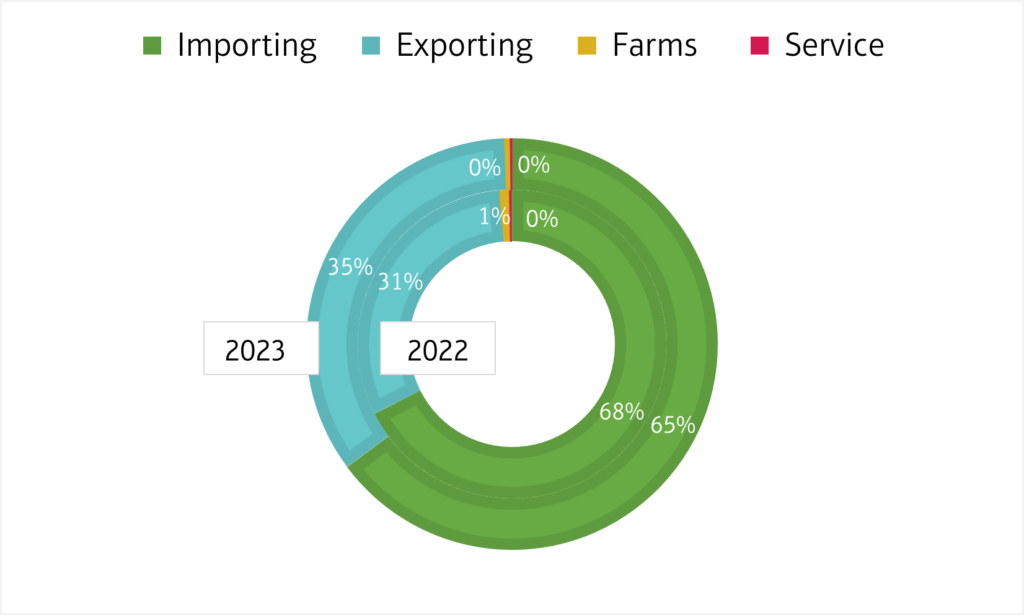

This chapter presents our updated 2023 corporate carbon footprint and compares it to our 2022 baseline. In the graphs, the inner circle represents our 2022 baseline while the outer circle shows our 2023 corporate carbon footprint. In this way, we want to clearly illustrate how the percentages of each category in our scopes have changed between the two years.

Scopes

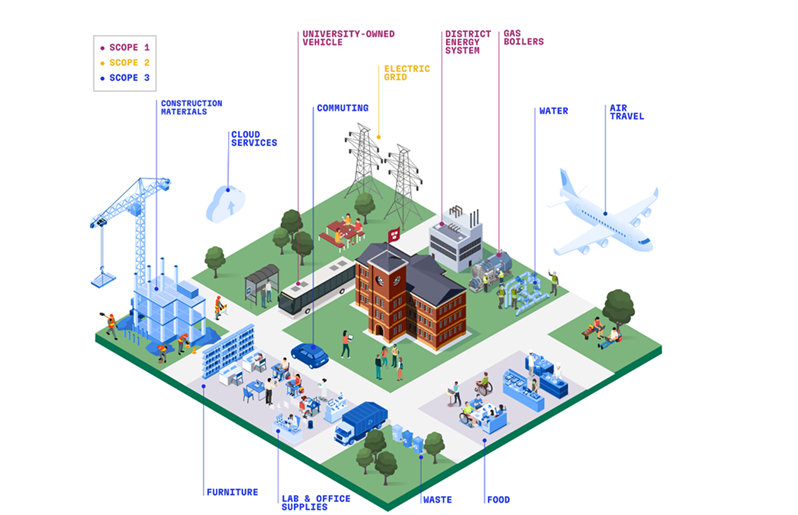

Given the diversity of our operations, we visualized our corporate carbon footprint and its boundaries in the graphic above. Our CCF calculation covers four different company profiles: our farms (focusing on coffee farming, nursery operations, and forestry projects), exporting companies (handling coffee procurement and export coordination), importing companies (procuring coffee for importation and domestic sales), and service companies (processing, warehousing and handling diverse support functions). Emission sources across these profiles include direct emissions from electricity generation, processing, and transportation in scope 1, indirect emissions from purchased electricity in scope 2, and a broad range of indirect emissions in scope 3 (e.g., transportation, waste management, employee travel, and coffee farming).

Corporate Carbon Footprint

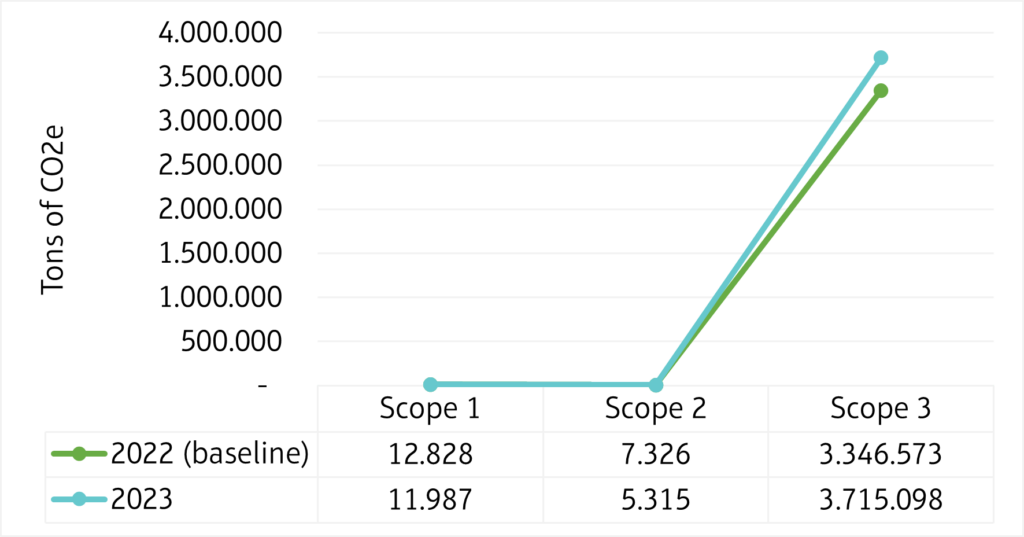

Figure 1 presents the corporate carbon footprint for 2022 (our baseline) and 2023 (our latest calculation). The contributions of each scope did not vary significantly from year to year.

- Scope 1: contributed 0.4 % in 2022 and decreased to 0.3 % in 2023.

- Scope 2: contributed 0.2 % in 2022 and decreased to 0.1 % in 2023.

- Scope 3: remained the largest contributor, increasing from 99.4 % in 2022 to 99.5 % in 2023.

Overall, our total corporate carbon footprint increased from 3,366,727 tons of CO2e in 2022 to 3,732,410 tons of CO2e in 2023, an increase of 10.86 %. This is mainly due to higher purchases of goods and services, expanded transportation activities, and energy consumption. Despite this increase, the contribution of each scope to our overall carbon footprint remained relatively stable in 2023.

Figure 1: Breakdown of corporate emissions in 3 scopes

Emission Breakdown by Company Type

Figure 2: Breakdown of corporate emissions by company type

The emissions breakdown by company type remained similar to our baseline, with importing companies representing the largest portion.

For importing and exporting companies, most emissions fall under scope 3 due to purchased goods and services. For farms, emissions are mainly in scope 1 because of the use of agrochemicals. Service companies, primarily warehousing, focus on scope 3 emissions from transportation.

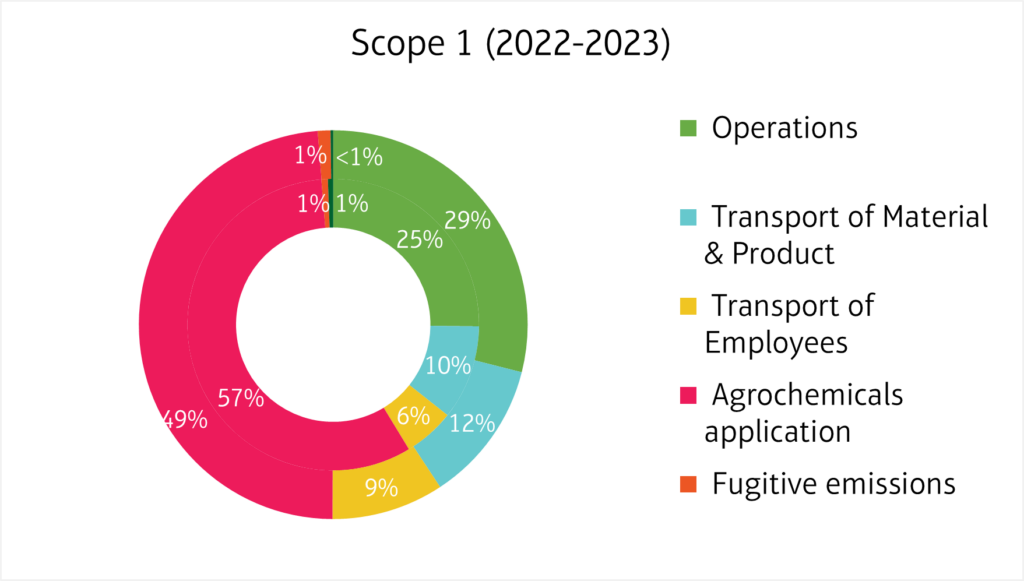

Scope 1

As previously described, scope 1 emissions made up 0.4 % of our total emissions in 2022 and 0.3 % in 2023. This corresponds to 12,828 tons of CO2e from our direct activities in 2022. Out of these, 97 % were attributed to the agrochemicals used on our farms. In 2023, our direct emissions decreased to 11,987 tons of CO2e. This was partly due to a 20.77 % reduction in emissions from agrochemicals, contributing to an overall 6.56 % drop in scope 1 emissions. During this period, fuel consumption for operations rose by 7 % while emissions from transport fuel fell by 5 %.

The majority of our scope 1 emissions come from farm operations, followed by those from exporting companies and mills.

Figure 3: Breakdown of direct emissions in 2022 and 2023

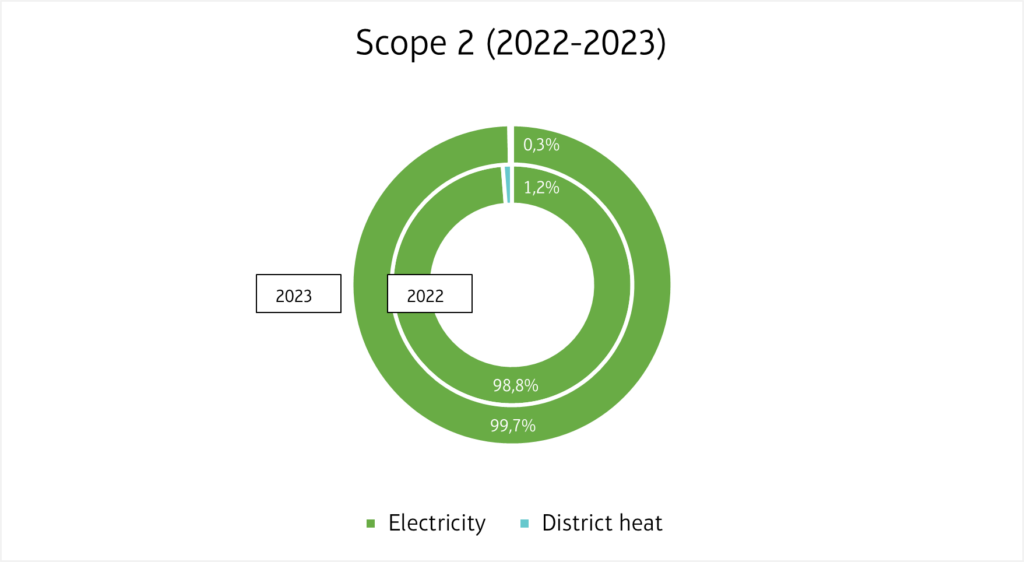

Scope 2

Figure 4: Breakdown of indirect emissions in 2022 and 2023

In 2022, the majority of our scope 2 emissions came from electricity consumption, with a smaller share attributed to district heating. By 2023, scope 2 emissions decreased by 28 % thanks to a greater adoption of renewable energy. In total, the share of renewable energy in our electricity mix increased from 25 % in 2022 to 33 % in 2023, as more of our group companies worldwide started generating or purchasing renewable energy.

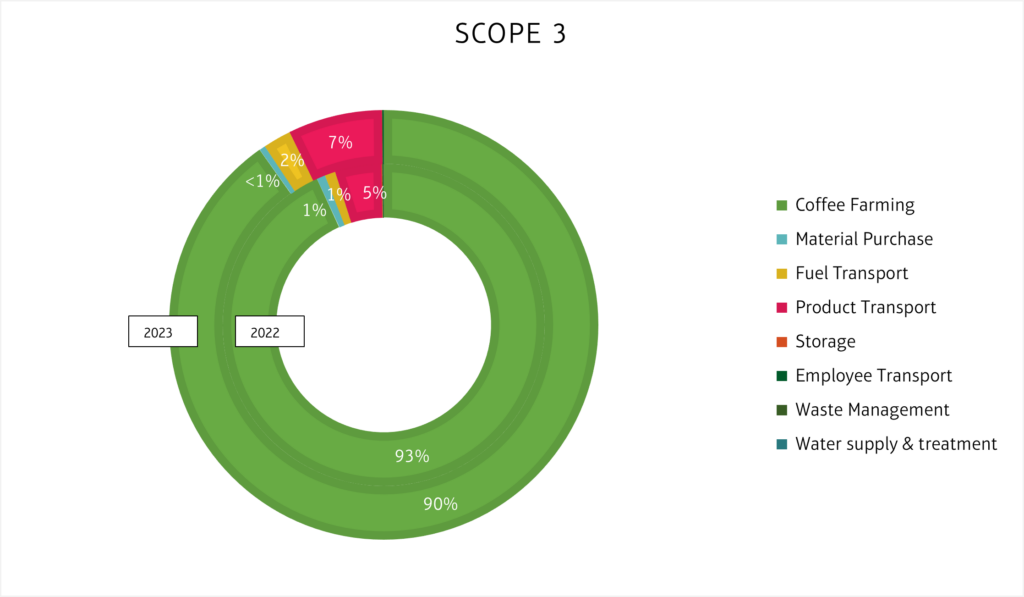

Scope 3

Our indirect emissions arise from various activities across our value chain, including coffee farming, third-party transportation, and material manufacturing. In 2022, scope 3 emissions, which are by far the largest portion of our corporate carbon footprint, accounted for 99.4 % of our total emissions, amounting to 3,346,573 tons of CO2e. In 2023, this figure saw a slight increase, reaching 99.5 % of our total emissions, or 3,715,098 tons of CO2e.

A significant share of these scope 3 emissions comes from coffee farming. As illustrated in the graph, coffee farming alone contributed at least 90 % to our indirect emissions in 2023. These emissions grew by 8 % from 2022 to 2023, largely due to business activities of our importing and exporting companies.

Product transportation is our second-largest emission category, representing 7 % to our overall corporate carbon footprint. Emissions from this category rose by 68 %, primarily due to increased coffee purchases and farming activities. Road transport, managed mostly by exporting companies, and sea transport, handled by importing companies, are the main sources of these emissions.

Material purchases, excluding coffee, are our third-largest emission source. This category saw a significant reduction of 40 %, now making up less than 1 % of our scope 3 emissions. This decrease is largely attributed to reduced use of agrochemicals.

Overall, scope 3 emissions increased by 11 % compared to previous year. As we gather and analyze more primary data, we will continuously refine our assessment of scope 3 emissions to better understand and address NKG’s environmental impact.

Figure 5: Breakdown of other indirect emissions in 2022 and 2023

Climate Action Plan

In 2023, after setting 2022 as our new baseline and reviewing our environmental footprint data, we outlined a path for climate action under objective 8 of our Responsible Business Program. Our work, so far, included the following steps:

- Measuring our baseline

- Identifying key focus areas for our climate strategy

- Designing a climate action plan (CAP)

Our climate action plan serves as a strategic framework that aligns our business strategies with a low-carbon economy, reflecting our commitment to environmental responsibility. It emphasizes both mitigation and adaptation strategies, aiming to integrate climate change considerations into every aspect of our operations. This includes decisions on mill construction, farming practices with our suppliers, and overall business activities. Our purpose-driven approach ensures that we not only reduce our climate impact but also adapt effectively to current and anticipated changes, maintaining both environmental sustainability and financial viability.

By the end of 2023, we established internal targets to decrease our greenhouse gas emissions. As a first step in this journey, we committed to reducing our scope 1 and 2 emissions by 3 % in 2024 and by 6 % in 2025. These short-term targets reflect our expectation of an exponential shift towards low-carbon practices within our business, which is why we opted for a more modest reduction in 2024, followed by a more ambitious goal in 2025.

For scope 3 emissions, we decided to delay the setting of specific reduction targets. Instead, we are focusing on enhancing and refining our Life Cycle Assessment (LCA) approach, particularly for our coffee farming emissions, which represent the largest part of our emissions. Additionally, we are working to improve the accuracy of our scope 3 data using primary sources before committing to any reduction targets.

To achieve our strategy and goals, we are concentrating our efforts on the following key focus areas:

Key Focus Areas

1. Greenhouse Gas Emissions

As part of our climate action plan, energy audits will be conducted in all our exporting companies to identify additional opportunities for emission reductions. Our group companies have started to actively work on decreasing transportation-related carbon emissions. So far, 16 % of our companies have implemented measures such as increasing the use of biofuels, transitioning to lower-emission fuels, adopting electric vehicles, using employee carpooling, and optimizing transportation routes.

Additionally, we have already improved energy efficiency in 35 % of our group companies through technological advancements and equipment upgrades. We will continue to prioritize this topic to significantly reduce our emissions.

2. Energy Consumption

In collaboration with 12 of our group companies, we have successfully elevated the proportion of renewable energy in our electricity mix from 25 % to 33 % between 2022 and 2023. A key focus of this effort is expanding on-site solar panel projects at our exporting companies and farms.

SPOTLIGHT

Solar Project at NKG East Africa

One notable initiative is the solar project at NKG East Africa. This case study highlights how our regional headquarters in Nairobi, through a partnership with Equator Energy, has pioneered a significant step towards reducing our carbon footprint. The project not only marks our first foray into solar energy within the region but also underscores our dedication to mitigating climate impact and advancing sustainability in our operations. The project is the first of its kind in our regional portfolio. Every kWh of solar energy consumed from the project, we avoid ~1 kg of CO2 and save ~0.05 l of water with a guaranteed savings from the discounted rates. The journey is on and in addition to the climate informed projects already in the pipeline, we will tirelessly work towards achieving our emission reduction targets.

At NKG East Africa, we have embraced the course to mitigate our impact on climate change and adapt our business to the current and expected changes. We acknowledge the greater contribution of the supply chain (scope 3) emissions to our footprint but are also certain that change must start from our in-house operations (scopes 1&2 emissions). At NKG, we are all about coffee and we shall protect this precious commodity from the impact of climate change.

Melyne Amolloh, Regional Responsible Business Program Manager East Africa

3. Raw material sourcing

Over the past months, we have expanded our monitoring efforts to include raw material sourcing, as we aim to reduce the environmental impact of our coffee export packaging. In 2022, 87 % of our packaging consisted of jute bags while plastic packaging made up just 13 %. By 2023, we reduced the use of plastic packaging to 10 %. Our transition to biodegradable Ecopil bags is another important step towards minimizing plastic waste and protecting the environment. These bags decompose naturally without leaving harmful microplastics, safeguarding ecosystems.

4. Water usage

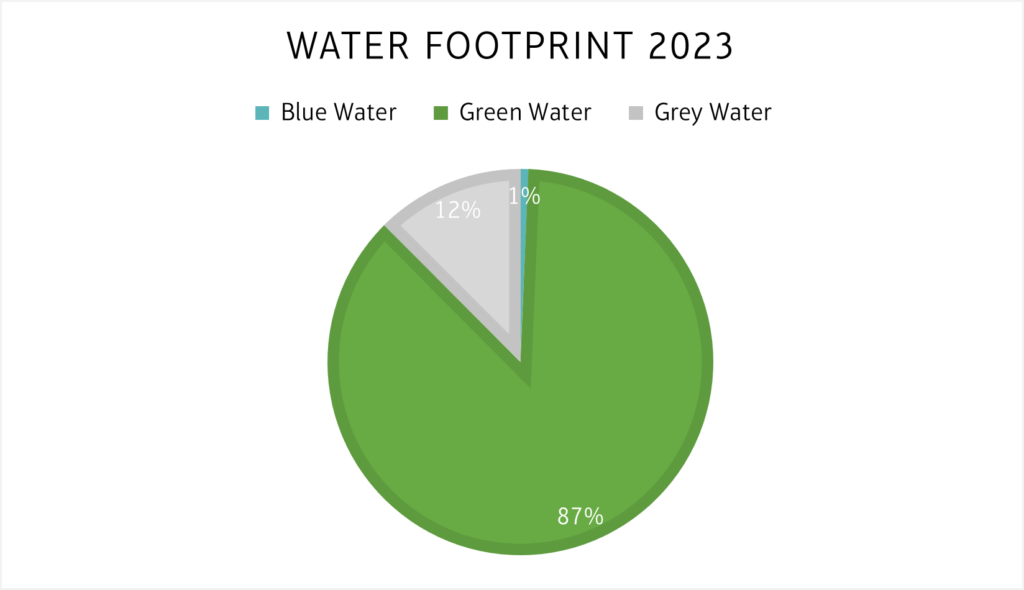

The water footprint is a crucial tool for assessing freshwater use, covering both direct and indirect consumption by consumers and producers. For corporations, the water footprint represents the total volume of freshwater used directly or indirectly in operations. It includes two key components:

- Operational (Direct) Water Footprint: The water a business uses and contaminates through its own activities.

- Supply Chain (Indirect) Water Footprint: The water used or polluted to produce the goods and services a business relies on.

The corporate water footprint combines blue, green, and grey water footprints. This approach follows the Water Footprint Assessment Manual by the Water Footprint Network2 and is typically measured as a volume of water per unit of time within a specific area or region.

- Blue Water: Fresh surface and groundwater, such as water from lakes, rivers, and aquifers, that is abstracted and not returned to the original source

- Green Water: Rainwater used for consumption that does not contribute to runoff

- Grey Water: An indicator of freshwater pollution linked to the production of goods throughout their supply chain

Figure 6: NKG Water Footprint 2023

In 2022, we calculated our corporate water footprint, including blue, green, and grey water for the first time. We consumed 193.31 million liters of blue water, 28,115.22 million liters of green water, and 4,012.97 million liters of grey water. In 2023, blue water consumption increased by 11 %, and grey water by 0.5 %.

To address our impacts, we are implementing various water conservation measures across our operations: In Mexico, Brazil, and Peru, our dry mill facilities are engaging in water conservation through wastewater treatment and recycling, which reduces the discharge of water into sewer systems and natural bodies. In Indonesia, we utilize semi-washed processing and recycle water to minimize waste.

In Mexico, we also use artificial dams to ensure efficient water usage and to adhere to regulatory standards for water quality, reintegrating treated water into natural bodies. In Uganda and Honduras, we focus on monitoring borehole water usage and employing biodigesters for natural treatment. In Costa Rica, our well-designed recirculated water system, complemented by third-party treatment, supports our wet mill operations. Additionally, in India, we prioritize responsible wastewater containment and treatment in septic tanks to prevent discharge into sewer systems.

All these efforts reflect our dedication to reducing our corporate water footprint and promoting sustainable water use throughout our global operations.

5. Waste generation

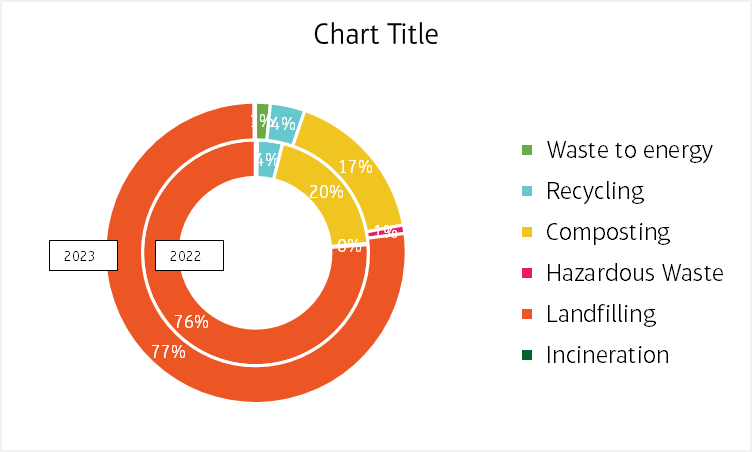

In 2022, we generated 9.6 thousand tons of waste. Of this total, 76 % was landfilled, 20 % was composted, and 4 % was recycled. In 2023, our overall waste quantity remained relatively stable, with minimal changes in waste management practices. However, we increased the portion of waste diverted to energy recovery.

In the future, we want to focus on innovative approaches to repurpose and reuse materials throughout our operations. Several of our exporting companies, for example, use coffee husks as a biofuel resource, reducing waste and providing a sustainable energy source. Additionally, Neumann Gruppe USA has partnered with GrainPro to facilitate the collection and recycling of coffee bags. This initiative helps to divert packaging waste from landfills, promoting reuse and recycling within the coffee industry. In this way, we want to minimize landfill waste and promote a circular economy.

Figure 7: Breakdown of waste management at NKG in 2022 and 2023

Conclusion

In 2023, we made significant strides on our emission reduction journey, achieving a 7% reduction in Scope 1 emissions and an impressive 27% reduction in Scope 2 emissions. These milestones were largely driven by our efforts on our farms and the increased use of renewable energy in our electricity mix. As outlined in our Climate Action Plan, we anticipate further reductions in 2024 and 2025, supported by initiatives already underway. These include conducting energy audits and implementing related measures across our exporting companies and farms, performing environmental risk assessments, and connecting additional renewable energy projects. For Scope 3 emissions, while we continue to enhance our access to primary data, we have also begun exploring potential emission reduction projects in key areas such as transportation and waste management. These efforts are part of our broader strategy to achieve meaningful and lasting reductions across our entire value chain.

References

2Hoekstra, A.Y., Chapagain, A.K., Aldaya, M.M. and Mekonnen, M.M. (2011) – “The Water Footprint Assessment Manual: Setting the Global Standard”, Earthscan, London, UK.

RELATED

sustainable

development

goals