Producers

7

BRIDGE THE

FINANCING GAP

the Importance of financial access for coffee farmers

While coffee farmers face various challenges, lack of access to financing is an issue that exacerbates everything else. The umbrella term “finance” can mean many different things to coffee farmers though:

Whereas one farmer requires quick cash to cover unforeseen expenses or to bridge a financial gap before their next income, another farmer needs to buy fertilizer on credit to ensure a successful next harvest. One farmer seeks an affordable loan to upgrade their diesel generator to solar-powered equipment, while another farmer needs to finance the replanting of a coffee plot, which will only yield sufficient coffee to repay a loan after two to three years.

Without access to sufficient finance, coffee growers may face difficulties in improving their farms as businesses, often finding themselves unable to make them profitable or attractive for subsequent generations. Without financial options, households are more susceptible to emergencies or external shocks. Consequently, farmers may consider shifting to quicker-yielding cash crops as immediate solutions, despite the potential long-term uncertainties this may bring to both their livelihoods and the coffee sector.

WHY DOES NKG HAve TO PROVIDE FINANCIAL SERVICES?

In many coffee origins, coffee farmers have difficulties accessing the right financial product at the right time and under acceptable conditions. Some financial institutions shy away from them due to perceived high risk and the unattractive nature of coffee producers as clients and, therefore, do not offer financial products to them. The perception of coffee farmers as “risky clients” results from the fact that coffee producers have a negative cash flow for most of the year as they are investing most of the time in inputs, labor, etc.; while in most coffee origins the income-generating harvest only happens once per year. Even with optimal care, the harvest then depends on weather and natural conditions and is under pressure from pests and diseases. Also, the remote location of many coffee farmers, often paired with comparable small-credit amounts, makes dealing with them less interesting for financial institutions.

To compensate for this type of coffee farmer client profile, financial institutions either ask for high interest rates or high collateral (or both), making formal financial products more of a burden than a solution. Financial products that are not tailored to the coffee-crop cycle, such as starting repayments for loans for new plantations after one year – although the new plants will only yield a full first harvest after three years – can endanger coffee producers’ financial stability and therefore have the opposite of the desired effect.

Coffee farmers who are able to earn decent incomes from the coffee business are the backbone of NKG’s business. In instances where financial institutions are not able or willing to provide financial services to coffee farmers in NKG supply chains, NKG can either directly provide these services or facilitate their provision indirectly. These services can range from short-term advance payments on future harvests, credit-based provisions of inputs, to long-term investment loans. NKG is able to do this because the company has long-term relationships with producers, has field teams that advise producers, not only on finance, but on coffee-related aspects as well, has a physical presence and proximity even in most remote areas and can accept collateral or repayments even as coffee. NKG can further leverage an extensive network of partners and use its relationships with banks to design or provide products that target specific producer groups or reward sustainable practices.

Smallholder Livelihoods Facility

With the objective of closing the persistent financing gap in twelve NKG coffee origins, NKG decided to launch the Smallholder Livelihoods Facility (SLF) in 2019. This innovative financing facility was among the first instances in which a commodity trader like NKG partnered with governmental and development organizations, as well as commercial banks, to enable easier access to financing for smallholder farmers. This combines a revolving credit line and a risk-sharing mechanism, which reduces the direct credit risk of loans awarded to smallholder farmers and farmer groups. The structure of the SLF enables NKG to scale the portfolio of loans awarded to coffee growers, enabling previously excluded farmers to gain access to financial services. The NKG exporting companies can utilize the revolving credit line to provide producers with credit through streamlined and rapid procedures. Through mobile money and digital payment technologies, NKG exporters ensure seamless transactions.

To the present date, the SLF has disbursed more than USD $10 million to smallholder producers in four countries: Mexico, Uganda, Kenya and Honduras. Most coffee farmers use the SLF for financing inputs, to cover short-term cash needs, or to invest in coffee plot renovation.

Cooperatives also make use of the SLF to upgrade their processing facilities, enabling them to achieve higher market prices for their members. By the end of 2023, the SLF had more than 16,000 active borrowers, out of whom, 27% were female and 23% were young people below the age of 35.

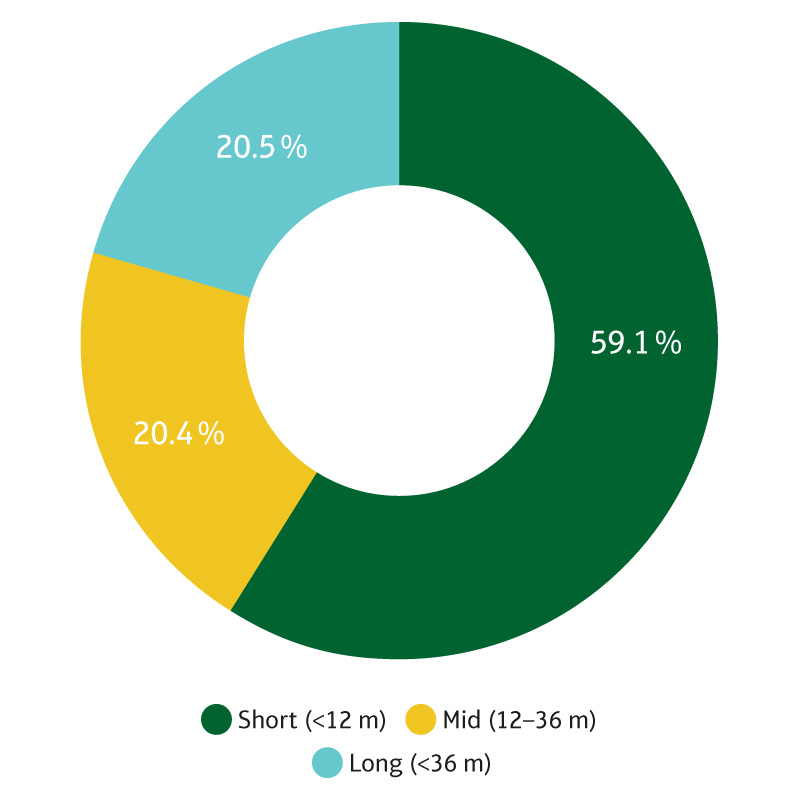

Portfolio Outstanding by Tenor

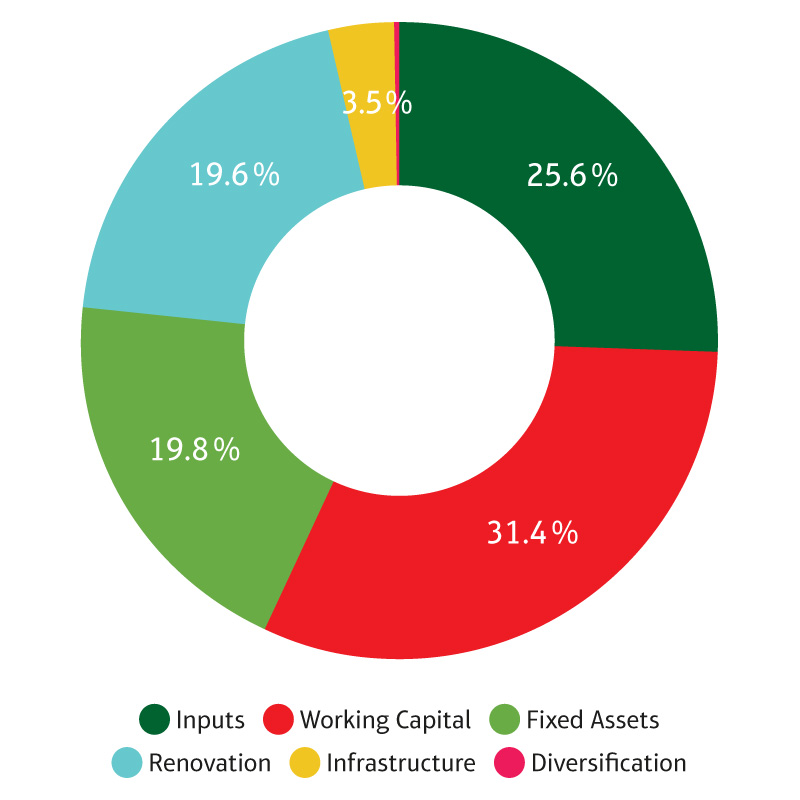

Portfolio Outstanding by Loan Purpose

TAILORING SERVICES for COFFEE SMALLHOLDERS

The financial services that coffee producers require and the level to which the requirements are met by local financial institutions, differ greatly between coffee producing regions. NKG is working to get a better understanding of the shortcomings in each region to see how the identified gaps can be closed, e.g.; through the SLF or by means of other structured mechanisms.

In 2023, NKG companies in cooperation with its partners conducted in-depth market and feasibility studies focusing on access to financing for coffee farmers in NKG supply chains. These assessments will result in concrete action plans towards closing identified financing gaps:

NKG Vietnam, in cooperation with Tchibo, conducted a study to identify models to provide financing to coffee growers excluded from formal financing, particularly members of ethnic minorities and uncertified producers. Results show that a future financing offer will need to predominantly focus on long-term lending.

Additionally, the study identified significant financial literacy gaps among farmers; therefore, future financial services will need to be accompanied by comprehensive training and support.

City Coffee Ltd (Tanzania) decided to commission NKG’s Sustainable Business Unit (SBU) to analyze its farmer service model, which includes the provision of financing and development of a roadmap towards scaling up services. This analysis identified the potential to leverage NKG’s SLF to upscale financial services for coffee growers in Tanzania.

As a result of this, as supported by the SBU, City Coffee Ltd. has begun scaling up its farmer services, as well as the formalization of financial services to coffee growers.

Beyond Smallholder Financing

ESG Finance in Brazil

In addition to smallholder financing, NKG companies engage in the interlinking of financing and sustainability practices. NKG Stockler Ltda. (Brazil) concluded a first ESG financing transaction with the Brazilian bank, Itaú BBA. This financing line is linked to Environmental (E), Social (S) and Governance-related (G) criteria and will be used to commercialize and export certified coffee, rewarding the investment through sustainability certification schemes.

Integrating sustainability practices and financing enables NKG Stockler to further promote sustainable and regenerative practices among coffee growers in its supply chains, as well as upscale impact in the Brazilian coffee sector.

RELATED

sustainable

development

goals